Case studies >>

Encompass

OpenCorporates’ data helps Encompass automate KYC due-diligence

Alan Samuels. Head of Product, Encompass

As part of their KYC (know-your-customer) due diligence obligations, financial services firms need to verify that a person or business is really who they say they are prior to onboarding.

More information than ever is expected to be gathered to support the initial verification and UBO discovery phases of KYC – making it difficult for firms to conduct the right due diligence checks whilst providing a smooth onboarding experience.

Encompass automates many of the time-consuming data collection steps firms typically conduct manually during KYC, such as the gathering of legal entity data from company registries, to help their clients understand the full picture about a prospective customer.

To achieve this at scale for their users, their RegTech solution needs to access trusted and reliable corporate records data from around the world.

Encompass chose to integrate OpenCorporates’ data into their platform via our API, as it fitted their approach of collecting the most up to date information at the point of need, as opposed to holding data themselves.

As a result, when Encompass users search for a company they want to conduct due diligence on, the relevant company data from OpenCorporates is returned automatically.

Accessing our data via the OpenCorporates API means that Encompass users can rely on data which is:

High quality: ensuring Encompass’ users can trust it

All OpenCorporates’ data is collected only from official company registries, meaning Encompass’ users can rely on it to power their due diligence efforts. Once a customer’s identity and ownership structure has been unwrapped, Encompass’ platform then cross-references the company against a range of other data sources to check for risk-related information, such as sanctions lists, politically exposed persons lists and other watchlists.Global: 140 jurisdictions’ worth of company data via a single subscription OpenCorporates’ data contains company information from 140 jurisdictions, meaning Encompass’ users benefit from insight across numerous jurisdictions – all via a single easily-managed subscription. As all this data is standardised into a consistent global schema, this makes it easier for Encompass to incorporate it into their platform and base repeatable processes around.

Provenanced: ensuring users can make confident decisions

All OpenCorporates’ company datapoints contain clear explanations about where they come from and when they were collected. This means Encompass’ users can make risk-based decisions with greater confidence, and also justify those decisions with official data.Flexible: allowing Encompass to scale up their usage when needed

Our API provides a single source of company data that can be easily scaled up and down based on demand from users of Encompass.

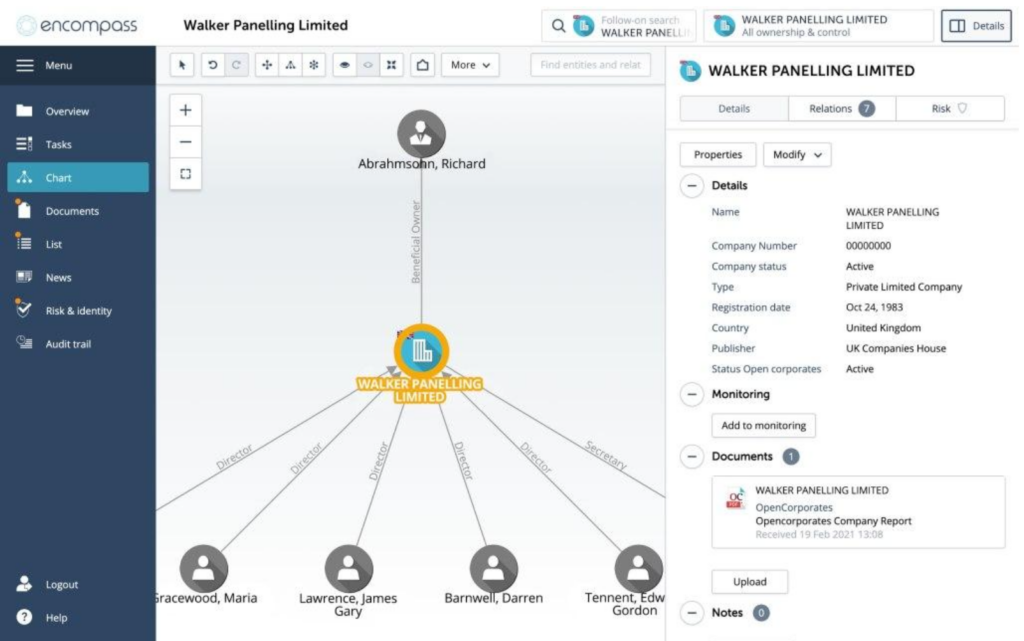

An indicative company profile from Encompass – displaying information about a fictitious company

Better understanding of prospective customers

By accessing the relevant company data, along with the other risk-related datasets Encompass interfaces with, users of the platform can make more informed onboarding decisions about prospective customers – based on the risks they may pose.Automation enables due diligence to scale

The identity of thousands of companies and their directors have been verified by users of Encompass using OpenCorporates’ data.Greater efficiency

The time saved where KYC analysts would previously have manually consulted company registers around the world has created efficiencies and allowed for a smoother customer experience during the KYC process.

A full and accurate picture of beneficial ownership is the foundation of effective KYC. Manually building this picture from a plethora of documents and third party data sources, however, is a long, expensive and error-prone process.

Encompass’ intelligent process automation conducts live document and data collection, analysis and integration from public and premium sources to bring transparency to complex corporate structures and ultimate beneficial ownership, delivering the most accurate and complete KYC on demand.

The full picture of a customer significantly enhances the effectiveness and efficiency of subsequent KYC activities including screening and IDV – both of which can be carried out seamlessly in the Encompass platform if required.

All information on a customer, along with supporting documents, is dynamically compiled into a comprehensive, digital KYC profile that Encompass can also monitor for ongoing regulatory risk.

Fresh, standardised, fully auditable information, underpinned by our Legal-Entity Data Principles, this is data you can trust.