Case studies >>

Quantifind

Quantifind powers financial crime investigations using OpenCorporates’ data

The success of investigations into money laundering and other financial crimes depend on an investigator’s ability to get the full picture quickly.

By using OpenCorporates' foundational legal-entity data, Quantifind could help investigators quickly see the big picture and make better, faster decisions.

Adam Mulliken, Senior Vice President of Analytics & General Manager for Financial Crimes, Quantifind

Investigations into money laundering and other financial crimes often start when unusual or anomalous transaction activity has been identified – but their success depends on an investigator’s ability to get the full picture quickly.

Quantifind approached OpenCorporates when they were building a machine learning-powered tool designed to automate the assimilation of many different types of information that support a financial crime investigation.

As investigators have long been slowed down by company information that is siloed across many different registries, Quantifind turned to OpenCorporates as an authoritative dataset that enabled access to the world’s official company information in one place.

Quantifind initially chose to incorporate OpenCorporates’ bulk data file of North American companies and officerships into their platform. More recently, they expanded this to include our full dataset, containing over 180 million companies and 220 million officerships from more than 130 jurisdictions.

Incorporating our data into Quantifind’s platform meant their users can leverage data which is:

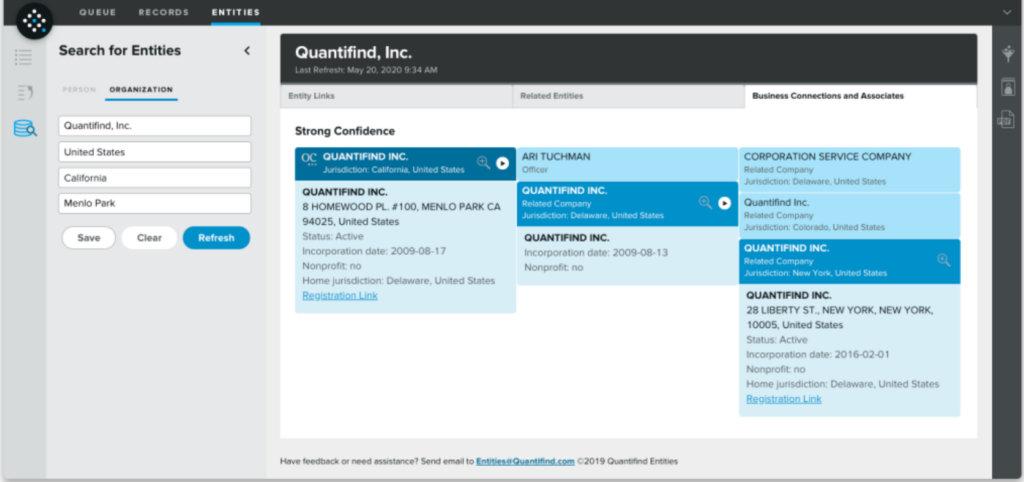

- Multi-jurisdictional: providing global context — As OpenCorporates’ data contains company information from over 130 jurisdictions, Quantifind’s users can incorporate global legal entity data into an investigation quickly.

- High quality: allowing investigators to accurately identify links to subjects — As our data is a standardised snapshot of the world’s companies, it was uniquely positioned to act as reference data from which to power the entity resolution capabilities Quantifind has built into their platform. This helps their tool to more accurately home in on the correct subject a user wants to investigate via a federated search, where it aggregates information from a range of different sources including watchlists, the open web or social media.

- Provenanced: meaning information can be leveraged with confidence — Quantifind’s users can build a case knowing they can prove the company registry data in their supporting evidence is collected directly from official company registers. This is because OpenCorporates provides the source from which all its datapoints originate. As some financial institutions’ policies give preference to evidence from official sources, this makes provenance all the more important.

- Easily consumed: ready to deploy quickly — As our data is standardized, this made it easy for Quantifind to ingest and deploy it in their platform.

Indicative search for a legal entity in Quantifind’s platform, showing results derived from OpenCorporates.

- Enables investigators to make better decisions

With OpenCorporates’ data, Quantifind’s users are able to understand the global context behind a person or legal entity they are investigating – helping them make more informed decisions. During a recent large-scale trial conducted by Quantifind, user data revealed that AML investigators relied heavily on general contextual information from the public domain, such as company registration data.

Of the search results users chose to highlight for inclusion in a downloadable report, only 15% were assessed as containing inherently risk-related information – with the other 85% containing purely contextual information. This illustrates the valuable role company data plays in helping investigators get the full picture about a subject.

- Saves time

Investigators using Quantifind’s platform are able to identify cross-border links between companies and people, which are fundamental in many financial crime typologies, rapidly via a single source. This meant they could focus their time on analysing data and uncovering risk instead of manually collecting company information and assessing the accuracy of each individual result.

Quantifind is a technology company whose AI platform uncovers risk signals across disparate and unstructured text sources. In financial crimes risk management, Quantifind provides an AI solution for anti-money laundering and fraud detection that uniquely discovers risk by combining internal financial institution data with public domain data.

Quantifind’s solutions for investigations and customer due diligence are delivered through a combination of APIs and a modern web application. Quantifind complements a Case Management platform implementation with one-click access to linked external data; the integrated capability allows investigators to stay anchored in one platform with access to all of the data needed to conduct a true 360° risk assessment.

Fresh, standardised, fully auditable information, underpinned by our Legal-Entity Data Principles, this is data you can trust.